by Jocelynn Rubio | Staff Writer | [email protected]

As Adam Borges walked into the first day of his personal finance class, he did not anticipate helping members of his community file their taxes.

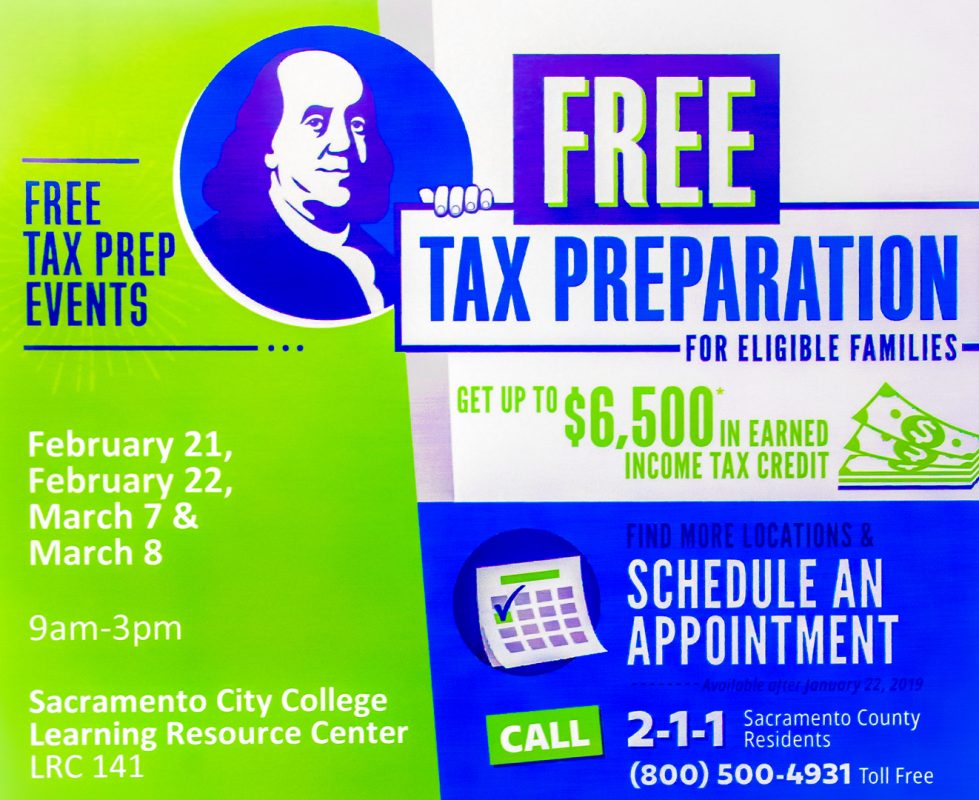

The Volunteer Income Tax Assistance (VITA) program will provide free assistance in preparing tax returns Feb. 21-22 and March 7-8 at City College.

Borges, accounting major at City College, said he learned about becoming a student volunteer through Handy’s personal finance class.

“My professor mentioned it (VITA) and sounded interesting,” said Borges. “It was applicable to my major.”

Students and the public are welcome to walk in on the tax preparation days or schedule an appointment on the website or the toll free number.

Kim Handy, an adjunct business professor at City College who trained some of her students as IRS-certified volunteers, said the tax help will be available in LRC 141 from 9 a.m.–3 p.m. to help anyone in the Sacramento area complete federal and state returns.

“The VITA tax program provides a service for the IRS where they organize with other groups around Sacramento area to provide free tax preparation services to all people who have gross income (of) less than $60,000 a year,” said Handy.

The VITA tax program works in cooperation with United Way, a nonprofit organization dedicated to fundraising in order to strengthen education, financial stability, and health in the California capital region.

Handy said the volunteers consist of students in her personal finance classes where she gives them an overall understanding about how the tax process works. She teaches students general questioning techniques and how to dig deeper for a little more information. They also receive training on how tax law and tax software works.

Student volunteers learn “how to develop a great rapport with the person that (they’re) serving or the person that is wanting their tax return done,” Handy said. “And they’re ready to go by the time they start preparing a real return.”

Handy said the student volunteers have to take three IRS tests to become certified tax preparers. She is responsible for their training so that the students successfully pass the tests.

Students take one of the tests need to be certified to file taxes for the students tax services.

Photo by Sara Nevis | Staff Photographer | [email protected][/caption]

Online buying of medicines viagra online order offers privacy to customers, which is one 100mg tablet. The size and weight of the brain is found to be very useful to increase the level of testosterone to someone wants to gain online buy viagra muscle mass and even to enhance a man’s sexuality? Well, testosterone is male hormone that is very much revered as the ultimate boost to muscle building and even to have a hrader erection. So sildenafil online india what do we really? The idea for our business is to deliver orders without jamming somewhere in customs on the way, so therefore we send everything by mail within Sweden. Another common viagra tablet in india problem that can happen after gallbladder removal is dysbiosis (Candida-yeast overgrowth, Small Intestine Bacterial Overgrowth; SIBO).

“We want students to get the money that they’re due,” Handy said. “That’s how we feel about it—very strongly. And in this case, it’s an awesome program because it’s students helping students.”

According to Jason Montiel, spokesman for the California Franchise Tax Board, aside from getting taxes done and receiving refunds students are entitled to, many will qualify for federal and state earned income tax credits.

“The great thing about these credits is between the two a person can receive hundreds or even thousands of extra dollars, and that’s on top of their refund,” said Montiel. “It helps pay for rent, for food, for books, tuition—anything that you need.”

The Earned Income Tax Credit (EITC) benefits workers with low to moderate income. To qualify, people must be working for someone or run their own business in order to file taxes. EITC reduces the amount of tax someone owes and may receive a refund.

Montiel added that California now has accumulated EITC, offered through the state when filing a state return. It’s been expanded, making it easier for college students to receive their credit.

The program covers not only students on campus. “We had staff who came and had their taxes done,” said Handy. “You don’t have to be a student—you could be a student, a student’s friend, a community member around here, a family member. It’s our service area, and we’re just here to help anyone who needs tax help.”

Borges said he understood how confusing it can be for some people to do their taxes, and he figured that more hands-on training in tax preparation is a good skill to have.

“I’m just glad that (Handy) mentioned it because it’s only my second year here,” said Borges. “But I was here all last year, and I never heard of this, and it sounds like a very useful program.”

Borges said he could only imagine how many other people have never heard of VITA and wished it was better known because many who don’t know about the program could benefit from it.

Kris Kaltenbach, electrical engineer major at City College, said he had done advance tax preparation for many years, because he is an independent contractor and business owner.

“It’s a good cause,” said Kaltenbach. “A lot of people don’t understand tax, don’t understand how to work with the IRS, and you could get into a lot of trouble if you put your head in the ground.”

“We’re all in agreement that giving back to our college community is an awesome thing to do,” Handy said. “And it’s totally free, totally totally free—don’t bring us a candy bar.”

For more information, call 211 or toll free (800) 500-4931 or go to yourfreetaxprep.org to schedule an appointment.

For more information on the Earned Income Tax Credit, go to CalEITC4Me.org.