Around the United States, people are feeling the crunch of debt — students at City College are no exception. Starting Oct. 1, payments on federal student loans resumed, after being frozen for over three years due to the pandemic.

President Joe Biden promised student loan forgiveness for eligible students, but this decision was ultimately overturned by the Supreme Court’s June 2023 opinion on the matter. According to a White House press release, Biden, along with Secretary of Education Miguel Cardona, attempted to forgive up to $20,000 in student debt for federal borrowers making under $125,000 a year, using a law called the HEROES Act, but the court rejected this interpretation of the law.

The HEROES Act, passed in 2003, allows the Secretary of Education to “waive or modify any statutory or regulatory provision applicable to” federal student loan programs, if they deem it necessary to ensure “recipients of student financial assistance . . . are not placed in a worse position financially” because of a national emergency, according to a statement by the Department of Justice. The law was previously used by former President Donald Trump to extend the student loan payment pause in March 2020.

“Six States sued, arguing that the HEROES Act does not authorize the loan cancellation plan. We agree,” Chief Justice John Roberts wrote for the court. The 6-3 decision dashed millions of students’ hope of escaping debt, which in some cases lasts past retirement, and is often increased significantly by interest.

Some City College students said they felt betrayed, or at least disappointed, by this reversal.

“Generally, a promise made that is implemented just for it to get ripped away feels very disingenuous,” said Xander Nelson, 22, who plans to transfer to a four-year college. “It feels like running on something and then taking it away doesn’t really give any weight to the other promises made by the administration.”

This decision seems to have rattled students’ faith in the Biden administration, and in some cases the prospect of higher education in general. “It makes me more hesitant to transfer to a four-year [school] because it’s harder to get my loans forgiven and I see my friends struggling with debt,” Nelson said. “I don’t want to struggle with debt, but also I need a good college education to get a worthwhile paying job.”

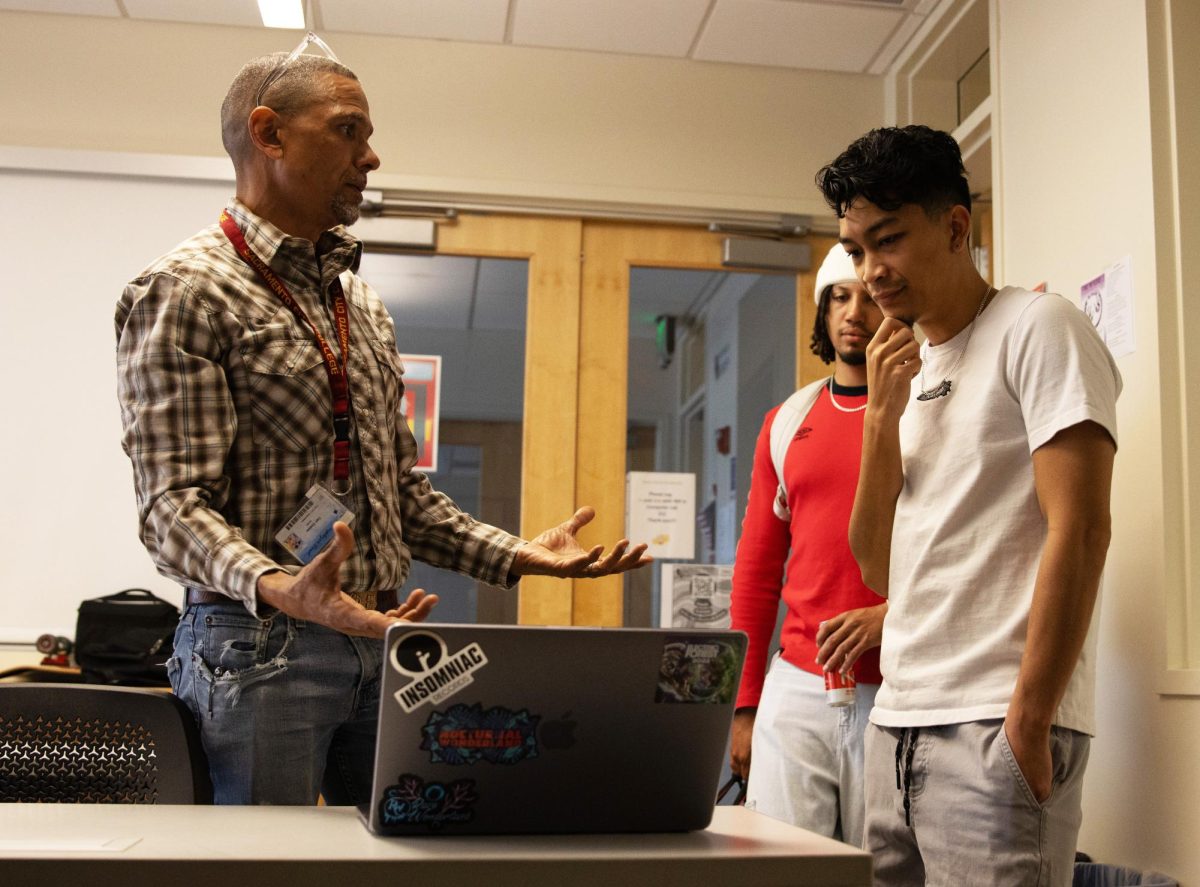

Other students saw the prospect of incurring debt as a necessary part of higher education. King Her plans to transfer from City College to either Cal Poly San Luis Obispo or UC Davis.

“It’s an investment,“ he said of a college education. “You shouldn’t be really afraid of [student debt]. The only thing you should be afraid of is if you’re not using it wisely.”

Rene Diaz, who has returned to City College to study engineering after earning his bachelor’s degree in biological science from UC Davis, stressed the importance of having a plan, and considering the debt-to-income ratio of his education goals. “I know what classes to take,” Diaz said. “I can try to finish faster to minimize the amount of loan and … be more efficient.”

Besides their course of study, several students said that the potential for incurring debt could have an effect on where they choose to study. Colton Baker, who is studying electrical engineering, plans to transfer to Sacramento State in part because “Sac State is a lot cheaper and more affordable compared to transferring to San Jose or Berkeley.”

However, while Sac State may be relatively affordable compared to other schools, all campuses in the California State University system will soon get more expensive. According to a recent Sacramento Bee article, “the trustees of the California State University system voted 15-5 Wednesday [Sept. 13] to approve raising tuition by 6% annually over a five-year period starting in the 2024-25 academic year,” citing deferred operation costs.

While the Biden administration’s initial plan was rejected, on Aug. 22, he announced an alternative: Saving on a Valuable Education (SAVE) Plan — formerly the REPAYE Plan. According to the Federal Student Aid website, this plan is one of four that are income-driven, meaning monthly payments are determined based on each borrower’s income, adjusted yearly as incomes and family size changes.

Income-driven plans allow borrowers to make payments that are tailored to be affordable for them. Additionally, the plan establishes income “floors,” based on federal poverty guidelines, below which borrowers may be eligible for low or even $0 payments.

Borrowers who make their monthly payments would also not accrue interest on their loans, even in cases where their payments are low or nothing at all based on their income. The downside of these income-driven plans is that they may take longer to pay off than the standard plans, and by extension generate more interest in the long term.

However, another advantage of this program is, according to the Federal Student Aid website, “Any outstanding balance on your loan will be forgiven if you haven’t repaid your loan in full after 20 years (if all loans were taken out for undergraduate study) or 25 years (if any loans were taken out for graduate or professional study).” This would at least ensure that borrowers are not saddled with student debt for life.

Another resource available for City College students is the Los Rios Promise Program. The program covers “resident tuition and enrollment fees (the cost of your classes) for up to 15 units, at $46 per unit” for eligible students, according to the Los Rios website. This isn’t a loan and doesn’t need to be paid back, giving students some modest but debt-free assistance.

~ Additional reporting by Sunny Silverstein, Emma Richman and Ellie Appleby.