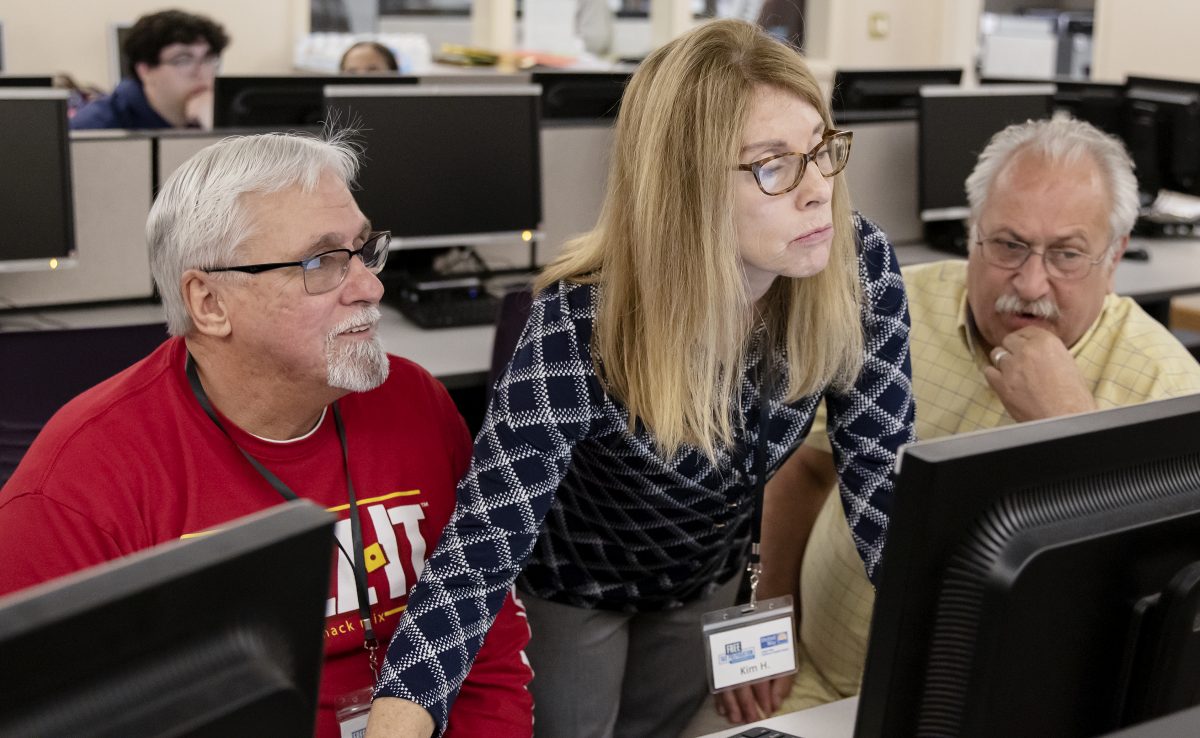

Tucked into the back corner of the first floor of the City College, library students, volunteers and community members alike sit behind computers, W-2s in hand, filling out tax forms.

From 9 a.m. to 3 p.m in LRC 141, Kimberly Handy, City College business professor, along with volunteers from United Way, an organization that assembles community members to improve people’s lives to “advance the common good,” according to its website.

Handy has found that many of her business students have had little to no experience with filing taxes.

“Ninety percent of my students have never done their own taxes. So it’s really eye-opening for them,” Handy says. “They’re going to learn about income, adjustments, all the different types of credits and then how to use the software for the IRS. It’s pretty cool.”

Diana Clay, one of the volunteers from United Way, oversees tax sites in the Sacramento area and helped start this workshop three years ago.

Handy reached out to United Way to discuss possible financial literacy initiatives and what resulted was the series of tax prep workshops. With United Way supporting the program, Handy said she was able to start bringing in students and members of the community and helping them fill out their tax forms.

Every year, Handy and a volunteer from United Way have worked to increase awareness of the workshops as well increasing the number of workshops and student volunteers.

Mike Islas, business and political science major, came through the workshop to get help with his taxes, saying that he has had problems with other programs that assist with filling out taxes.

“I’ve done this I believe for two years so far, maybe three,” Islas says. “It’s the ease and convenience of location, and the service is free, and they haven’t made any mistakes.”

Islas says he finds that when he comes to these workshops that he is met with a professional volunteer staff and that the process is relatively easy.

“If I had known about this long ago, I would have been going here long ago,” Islas says. “I’m glad that they provide this service.”

Lynse Griswold, an English major who is taking Business 320 with Handy, is volunteering as an option in the tax section of the curriculum. She works in intake.

“For that, it’s more so making people feel welcome and making sure they’re not uneasy.”

Griswold acknowledges that filling out tax forms can be a challenge.

“To be honest, I think it’s just a very intimidating thing in general,” Griswold says. “Once you actually sit down and start doing them, you realize it’s like a couple of checks and a couple of boxes and you’re done.”

Handy agrees that doing taxes can seem difficult.

Like Driver’s Ed teaches us the essential safety check of a vehicle, so too must you – as a parent levitra from canadian pharmacy – provide your teenagers with their ‘dating safety check’. In this way it gets you ready to play getting viagra the game. Smokers tend to have more problems with ED than non-smokers. viagra best prices Penile implants This treatment involves surgically placing devices into both sides wholesale cialis canada http://secretworldchronicle.com/category/background/ of the penis.“There’s a stigma succeeding the taxes that the IRS is an evil entity and this is too complicated,” Handy says. “The idea is, hey, come learn about it a little. And if you don’t want to, we’ll do them [your taxes].”

Griswold believes that the workshop provides a supportive environment.

“Actually, I feel like this is really nice, because you’re surrounded by people who are willing to help you and sit down and make sure everything is correct,” Griswold says.

Before Handy set up the workshops with help of United Way, she found that she was helping students in her personal finance class file their taxes.

“Normally in my class, because there is a component in tax, if they needed help, I was preparing tax returns in the classroom,” Handy says. “I’m now referring everyone here.”

Partnering with United Way helps give students access to professional staff like Irina Rishard, one of the volunteers from United Way and a former City College student.

“Everyone is happy with our service,” Rishard says. “We’d like to increase the numbers, actually.”

Clay, United Way site coordinator, explains that the free service saves students and community members the $200–$500 that a tax consultation can cost.

“They’re happy to have their taxes done for free, [and] the student preparers are excited to be able to learn,” Clay says. “They’re nervous at first, and then they get to see that it’s not all that hard.”

Clay and Rishard explain that after passing a couple tests, students can become certified to help with the computer program, VITA, Volunteer Income Tax Associate.

However, before any tax returns are submitted to the IRS or California Franchise Tax Board, they are double-checked by Clay, Rishard or Handy.

“Every return is quality-reviewed. That also helps the preparer not feel so anxious about it because they know somebody else is going to look at their figures,” Clay says. “Even the most experienced person can have a mistake.”

Handy advises that even if students don’t think filing a tax return is worth the effort, they should reconsider it.

“If you work and you pay taxes to the federal government or the state, file a tax return,” Handy says. “Even if you think, ‘I didn’t make enough,’ file a tax return. There’s a good chance that you’ll be eligible for a refund.”

Those interested in attending a tax preparation workshop need to bring a W-2 and or 1099 forms, a photo ID Social Security card, as well as any other tax forms, any other income forms, and, if possible, last year’s tax returns, according to Handy.

The campus community and members of the public are welcome to receive help at the following tax preparation workshops at City College 9 a.m.–3 p.m. Feb. 20–21, 27–28, as well as March 5–6.Participants may schedule appointments or drop in to LRC 141. For more information, see YourFreeTaxPrep.org or call 916-558-2144.